How to Invest: A Modern Guide to Building Wealth and Security

By Cyprus Prime Property Editorial Team

Investing is not just about money — it’s about vision, discipline, and long-term confidence. Whether you are saving for retirement, creating passive income, or seeking to protect your capital against inflation, understanding how to invest wisely is one of the most valuable skills you can ever develop. In 2025, the world of investing has evolved beyond stocks and bonds — it now includes real estate, renewable energy, and even global property opportunities in destinations like North Cyprus.

1. Understanding the Purpose of Investment

The first step in any successful investment journey is understanding why you want to invest. Is it financial independence? Wealth preservation? Or passive income? Your goals define your strategy. Investors who know their objectives make smarter, calmer decisions — even when markets become volatile.

Investment is not a gamble. It’s a calculated process of aligning capital with opportunity. Every investor should balance three key elements: risk, return, and time. The longer your horizon, the more freedom you have to let growth and compounding do their work.

2. Building the Right Mindset

Before numbers, there is mindset. A good investor learns patience, discipline, and critical thinking. The difference between success and failure is rarely timing — it’s behavior. History shows that those who hold steady through uncertainty outperform those who panic or chase trends.

In 2025, inflation, interest rates, and global shifts in energy policy have made investors more cautious. Yet, crisis often creates opportunity. The investor mindset is not about reacting — it’s about anticipating.

3. The Golden Rule: Diversification

Every serious investor understands the saying: “Don’t put all your eggs in one basket.” Diversification is the ultimate form of protection. It means spreading your capital across different asset classes — equities, real estate, commodities, and alternative assets like renewable energy or private equity.

A balanced portfolio may include:

- Stocks and ETFs for liquidity and long-term market growth

- Real estate investments for stability and tangible value

- Commodities and precious metals as inflation hedges

- Renewable energy and infrastructure for sustainable growth

Smart investors seek balance, not extremes. Diversification doesn’t guarantee profit — but it minimizes the risk of loss.

4. The Power of Real Estate

Among all asset classes, real estate remains one of the most trusted. Land and property have intrinsic value — they provide housing, rental income, and long-term appreciation. While financial markets fluctuate daily, well-located property grows quietly and steadily.

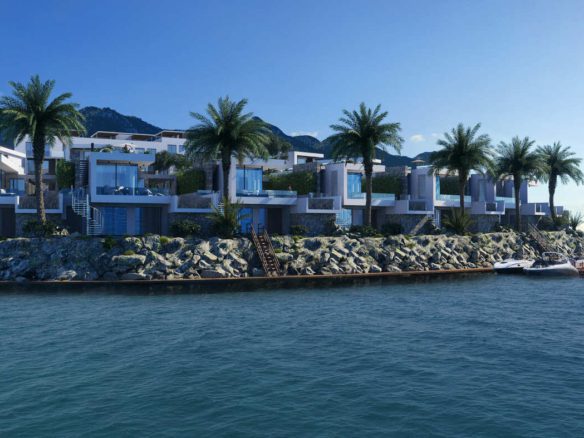

Global investors increasingly favor regions with high growth potential and low taxation. Northern Cyprus, for example, has become a rising star in real estate investment due to its Mediterranean climate, affordable prices, and strong rental demand. With minimal property taxes and flexible ownership laws, it attracts international investors looking for diversification beyond the EU’s regulatory burden.

5. Emerging Markets and Why They Matter

Today’s most profitable opportunities are not always in traditional financial centers. Emerging markets — from Southeast Asia to the Eastern Mediterranean — are experiencing rapid growth, demographic expansion, and infrastructure development. These regions offer higher returns, albeit with slightly higher risk.

North Cyprus is one such example. Its property market has matured from a niche destination into a serious investment hub. Projects like Long Beach, Iskele, and Esentepe attract both lifestyle buyers and professional investors. Early participants benefit from significant appreciation and rental yields that often exceed 8–10% annually.

6. Passive Income and Long-Term Security

True wealth is built not from working harder, but from letting your money work for you. Passive income — such as rent, dividends, or interest — is the foundation of financial independence. Investing in assets that generate consistent cash flow ensures security regardless of economic cycles.

Real estate in stable regions can deliver this combination: monthly rental returns, long-term appreciation, and protection against inflation. In Cyprus, for instance, foreign buyers can also benefit from a favorable residency program — turning an investment into a lifestyle upgrade.

7. Risk Management and Due Diligence

Every investment carries risk. The key is managing it intelligently. Before committing your capital, always ask:

- Who manages the project or fund?

- What are the legal guarantees or ownership structures?

- What is the expected yield, and how realistic is it?

- What are the exit options if you want to sell?

Working with transparent, established partners is essential. For example, Cyprus Prime Property collaborates only with the island’s most experienced developers, ensuring legal security, title deed protection, and reliable project delivery.

8. The Role of Professional Advice

Financial and legal guidance are not expenses — they are insurance for your capital. Consulting professionals for taxation, residency, or property law ensures that your investment remains compliant and profitable.

German investors, for instance, often prefer purchasing through EU-registered entities like SunShine Sales GmbH, based in Nuremberg. This provides clear documentation, legal recourse, and secure cross-border handling.

9. Sustainability: The Future of Investing

In the 2020s, sustainability is no longer optional — it’s profitable. Investors are now favoring eco-friendly developments, renewable energy integration, and smart building technologies. Projects in North Cyprus increasingly adopt solar energy, efficient insulation, and green materials — appealing to conscious investors who seek both return and responsibility.

Investing in sustainable real estate is not only good for the planet — it future-proofs your portfolio.

10. A Step-by-Step Framework for Beginners

- Define your goals: Decide what you want — income, growth, or security.

- Analyze your financial situation: Determine how much capital you can invest safely.

- Educate yourself: Learn basic financial literacy and property fundamentals.

- Start small: Test one market or project before expanding.

- Diversify gradually: Add different assets over time.

- Monitor and rebalance: Review your portfolio every 6–12 months.

Investment is a journey — not a race. The sooner you start, the greater the compounding effect.

11. Why Location Matters More Than Ever

In real estate, location determines success. It’s not just about scenery — it’s about connectivity, infrastructure, and growth potential. Cyprus’s combination of strategic position, EU access, and stable climate makes it one of the Mediterranean’s most attractive property markets.

From Iskele’s beachfront residences to Kyrenia’s luxury villas, the island offers investment diversity for every profile — from first-time buyers to institutional investors.

12. Investing Beyond Borders

Global investors understand that diversification means thinking internationally. Investing beyond your home country reduces political and currency risk while opening access to growing economies. North Cyprus, with its English-speaking professionals, transparent legal framework, and attractive returns, has become a favored destination for Europeans, Britons, and Middle Eastern investors alike.

13. Conclusion: From Saving to Freedom

The art of investing is about more than numbers — it’s about creating options. Every euro, pound, or dollar you invest today is a step toward independence tomorrow. Whether you choose stocks, property, or renewable energy projects, the principles remain the same: diversify, think long-term, and align with trusted partners.

If you’re ready to explore real estate opportunities in one of the Mediterranean’s most dynamic markets, contact Cyprus Prime Property — your trusted guide to secure, sustainable, and profitable investments.

- Villa

- £465K

Luxury Villas for Sale near Famagusta – Nature, Comfort & Mediterranean Living 4+1 Villa, 227m² with private Pool

Londra sokak- Beds: 3

- Baths: 3

- 253 m²

Contact me

- Apartment

- Start from £224K

Secure Your 2+1 Apartment in D-Point, Long Beach Iskele – Luxury Off-Plan Residences, Completion 2028

Iskele Long Beach- Beds: 2

- Bath: 1

- 113,73 m²

Contact me

- Apartment

- From just £168K

Invest Smart in D-Point: Modern 1+1 Apartments in Long Beach, Iskele – Off-Plan Opportunity Until 2028

Iskele Long Beach- Beds: 2

- Bath: 1

- 79,71 m²

Contact me

- Apartment

- Start from £210K

Querencia 1+1 Apartments – Modern Mediterranean Luxury in Long Beach, Iskele | From £210,000 | Completion April 2026

Iskele Long Beach- Bed: 1

- Bath: 1

Contact me

- Studio

- Start from £145K

Querencia Studios BCD – Luxury Seaside Living in Long Beach, Iskele | From £144,000 | Completion April 2026

Iskele Long Beach- Bed: 1

- Bath: 1

Contact me

- Apartment

- Start from £254K

Querencia 2+1 Apartments – Spacious Coastal Elegance in Long Beach, Iskele | From £254,000 | Completion April 2026

Iskele Long Beach- Beds: 2

- Baths: 2

Contact me

- Apartment, Penthouse, Studio

- Start from £130K

D-Point Studio Apartments – Modern Living in the Heart of Long Beach, Iskele

Yeni İskele 9955- Bed: 1

- Bath: 1

- 42.63 m²

Contact me

- Apartment, Penthouse, Villa, Residential

- Start from £214K

- £2

Natulux Villas & Residences – Redefining Coastal Luxury in North Cyprus

Tatlısu Sk, Girne 99645Contact me

- Apartment, Penthouse, Studio

- Start from £176.9K

Grand Sapphire Phase 4 – 7-Star Privileges | Perfect Residence Life

Güven sokak No:1, Cevizli, Mahallesi- Beds: 2

- Bath: 1

- 96 m²

Contact us

Please quote property reference

Cyprus Prime Property – your trusted partner for luxury villas, modern apartments, and smart real estate investments in Northern Cyprus. - CPP-18561